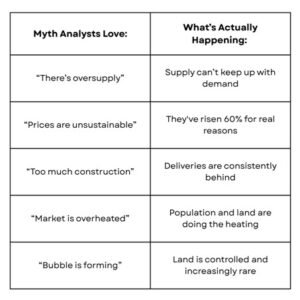

Every year, like clockwork, someone announces Dubai’s property market is about to crash. The headlines roll out like it’s breaking news: “Correction Imminent,” “Bubble Alert,” “Oversupply Crisis.”

It’s practically a seasonal sport.

- In 2024, S&P Global said the market would drop 10–20%. Never happened. On the contrary, prices kept going higher — bring that report and burn it.

• In 2025, Fitch Ratings joined the party with a fresh warning: up to a 15% decline. Are we gonna burn this report next year? Let’s hope so.

Media outlets ran with it like it was biblical prophecy.

But here’s the thing: Dubai’s market just shrugged… and kept booming.

It’s Easy to Be a Broken Clock

Let’s face it—predicting a downturn is easy. Safer, even.

- If you’re wrong, you were “cautious.”

• If you’re right, you’re a genius.

• But if you’re optimistic and wrong? Suddenly, you’re the reckless guy who bet the farm.

No wonder analysts keep calling for a crash—it’s risk-free credibility. Like a broken clock, they’ll eventually be right. Once. Maybe. But it doesn’t mean they understood the mechanism.

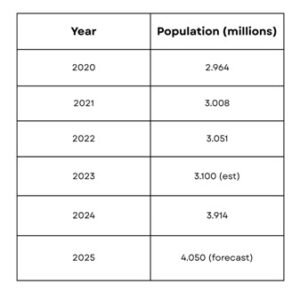

Population Growth: The Concrete Justification

From 2020 to 2025, Dubai will have added over 1 million new residents — that’s more than 200,000 new homes required, assuming a 5-person household.

Population Growth Table:

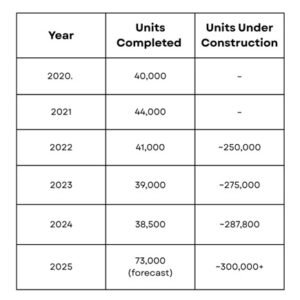

But Wait, What About All Those Cranes?

Yes, everyone loves the “100,000 units under construction” stat. But here’s what the data actually shows:

Housing Delivery Table:

And Prices? They’re Laughing at the Forecasts

Residential property prices in Dubai have surged by around 60% from 2022 to early 2025.

Why? Simple.

- Global investors are chasing yield and safety.

• Dubai offers zero income tax, a golden visa, and bulletproof infrastructure.

• It’s a haven in a world full of noise.

Meanwhile, the World’s Problems Are Dubai’s Pipeline

- Russia–Ukraine war? Capital flight to Dubai.

- UK tax overhaul? Wealthy families relocate, and funds shift headquarters.

- Middle East tension, Iran-Israel conflict? Dubai becomes the calm in the chaos.

Land: The One Metric No One’s Talking About

- Land prices have tripled in many prime areas since 2020.

- The government is strategically limiting new plot releases.

- Scarcity is intentional—it’s urban planning, not a glitch.

Let’s Talk Money

Dubai’s real estate isn’t just a side hustle—it’s a pillar of the economy.

- In 2024, total transactions hit AED 761 billion ($207.22 billion).

To put a number to a value you can understand, this is a higher property transaction than New York, Paris, London, Tokyo, Hong Kong – COMBINED!

- And it’s not slowing down; The government’s D33 strategy? It aims to double the economy and position Dubai as one of the top 3 global financial hubs.

The Real Estate Punchline

Final Thought

These analysts keep shouting “bubble!” like they’re the guy in Times Square with a cardboard sign and a bell, screaming that Armageddon is near. Meanwhile, 4 million people are living, buying, and investing in the city — and they say, “we’re all doomed.”

So next time someone whispers, “Dubai’s about to crash,” ask them:

“You saying that from a chart…?”

Because if they’re not on the ground, they’re probably just another broken clock waiting to be right.

About the Author

Hamzah Abu Zannad is the co-founder and Managing Director of Axiom Prime Real Estate Development. With over 20 years of experience in Dubai’s ever-evolving real estate sector, he brings deep industry insight and a passion for innovation to every project. Hamzah has been instrumental in shaping Axiom Prime’s vision—championing Dutch-inspired, luxurious developments that prioritize sustainability, smart design, and community living. His leadership has driven landmark projects in Jumeirah Village Triangle and Jumeirah Garden City (Satwa), setting new standards for modern urban living in the region.

To learn more, visit Axiom Prime Real Estate Development.

Also Read :-

Sharjah Solidifies its Standing as a Regional Real Estate Investment Centre